osceola county property tax estimator

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email. The consideration is presumed to be equal to the fair market value of the real property.

Osceola County Property Appraiser How To Check Your Property S Value

407-742-3995 Driver License Tag.

. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email Cart. Payment due by June 30th. Scarborough CFA CCF MCF Osceola County Property Appraiser.

For more information go to the Tax RollMillages link on the homepage. We use a Market Value range of 875 to 1125 of the purchase price you enter. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Osceola County Tax.

Counties in Florida collect an average of 097 of a propertys assesed fair market value as property tax per year. The median property tax also known as real estate tax in Osceola County is 188700 per year based on a median home value of 19920000 and a median effective property tax rate of 095 of property value. OSCEOLA COUNTY TAX COLLECTOR.

The median property tax in Osceola County Iowa is 734 per year for a home worth the median value of 70200. Expert Results for Free. Minimum stamp tax on any conveyance having a total consideration of 100 or less 070 Deed shown as corrective or given.

Michigan is ranked 1239th of the 3143 counties in the United States in order of the median amount of property taxes collected. For comparison the median home value in Osceola County is 19920000. Learn all about Osceola County real estate tax.

Property Appraisers Office 2505 E Irlo Bronson Memorial Hwy Kissimmee FL 34744. Florida is ranked number twenty three out of the fifty states in. Osceola County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax.

Osceola County Clerk of the Circuit Court Kelvin Soto 2 Courthouse Square Kissimmee Florida 34741. Easily Find Property Tax Records Online. Iowa is ranked 1978th of the 3143 counties in the United States in order of the median amount of property taxes collected.

Pay property taxes tangible taxes or renew your business Tax. Osceola County Florida Property Search. Tax amount varies by county.

2505 E Irlo Bronson Memorial Highway. Please fill in at least one field. Get Reliable Tax Records for Any Osceola County Property.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Ad Tax Records for Osceola County Properties Have Been Digitized. Parcel Number Owner Name Address.

Osceola County Florida Property Search. The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200. Whether you are already a resident or just considering moving to Osceola County to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

Just Enter Your Zip for Free Instant Results. The estimated tax range reflects the lowest to highest total millages for the taxing authority selected. Do not enter street types eg.

For comparison the median home value in Osceola County is 10110000. Osceola County has one of the highest median property taxes in the United States and is ranked 516th of the 3143 counties in. Parcel Number Owner Name Address.

Street Number 0-999999 or Blank Direction. Osceola County Property Appraiser. Osceola County collects on average 114 of a propertys assessed fair market value as property tax.

Irlo Bronson Memorial Hwy. OSCEOLA COUNTY TAX COLLECTOR. Parcel Number Owner Name Address.

If purchasing new property within Florida taxes are estimated using a 20 mill tax rate. Look Up a Home Now. Osceola County collects on average 105 of a propertys assessed fair market value as property tax.

There are typically multiple rates in a given area because your state county local schools and emergency responders each receive funding partly through these taxes. Osceola County Florida Property Search. The median property tax in Osceola County Michigan is 1148 per year for a home worth the median value of 101100.

14 the total of estimate taxes discounted 6. Parcel Number Owner Name Address. Search all services we offer.

097 of home value. Osceola County collects on average 095 of a propertys assessed fair market value as property tax. Tangible personal property tax is an ad valorem tax assessed against the furniture fixtures and equipment located in businesses and rental property.

Ad Just Enter your Zip Code for Property Tax Records in your Area. Please note that we can only estimate your property tax based on median property taxes in your area. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Dont have a driver license. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Osceola County Tax.

Cost of Home.

Osceola County Proposes Flat Property Tax Rate Orlando Sentinel

Ayment Ptions Osceola County Tax Collector

![]()

Osceola County St Cloud Propose Smaller 2021 22 Budgets Osceola News Gazette

Property Search Osceola County Property Appraiser

Ayment Ptions Osceola County Tax Collector

Osceola County Property Appraiser How To Check Your Property S Value

Property Search Osceola County Property Appraiser

Osceola County Tax Collector S Office Bruce Vickers Government Organization Facebook

Katrina Scarborough Property Appraiser Osceola County Property Appraiser Linkedin

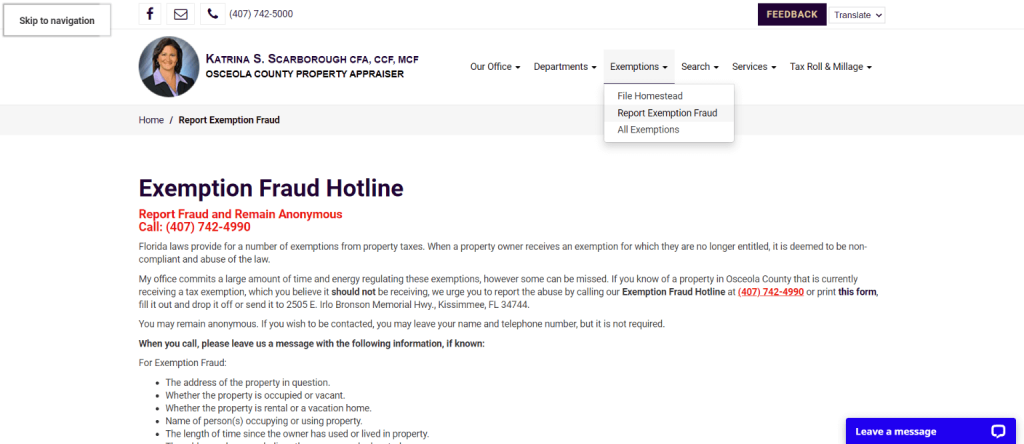

Osceola County Property Appraiser Katrina S Scarborough Cfa Ccf Mcf

Osceola County Tax Collector S Office Bruce Vickers Government Organization